Back to blog

Influencing Economic Policies

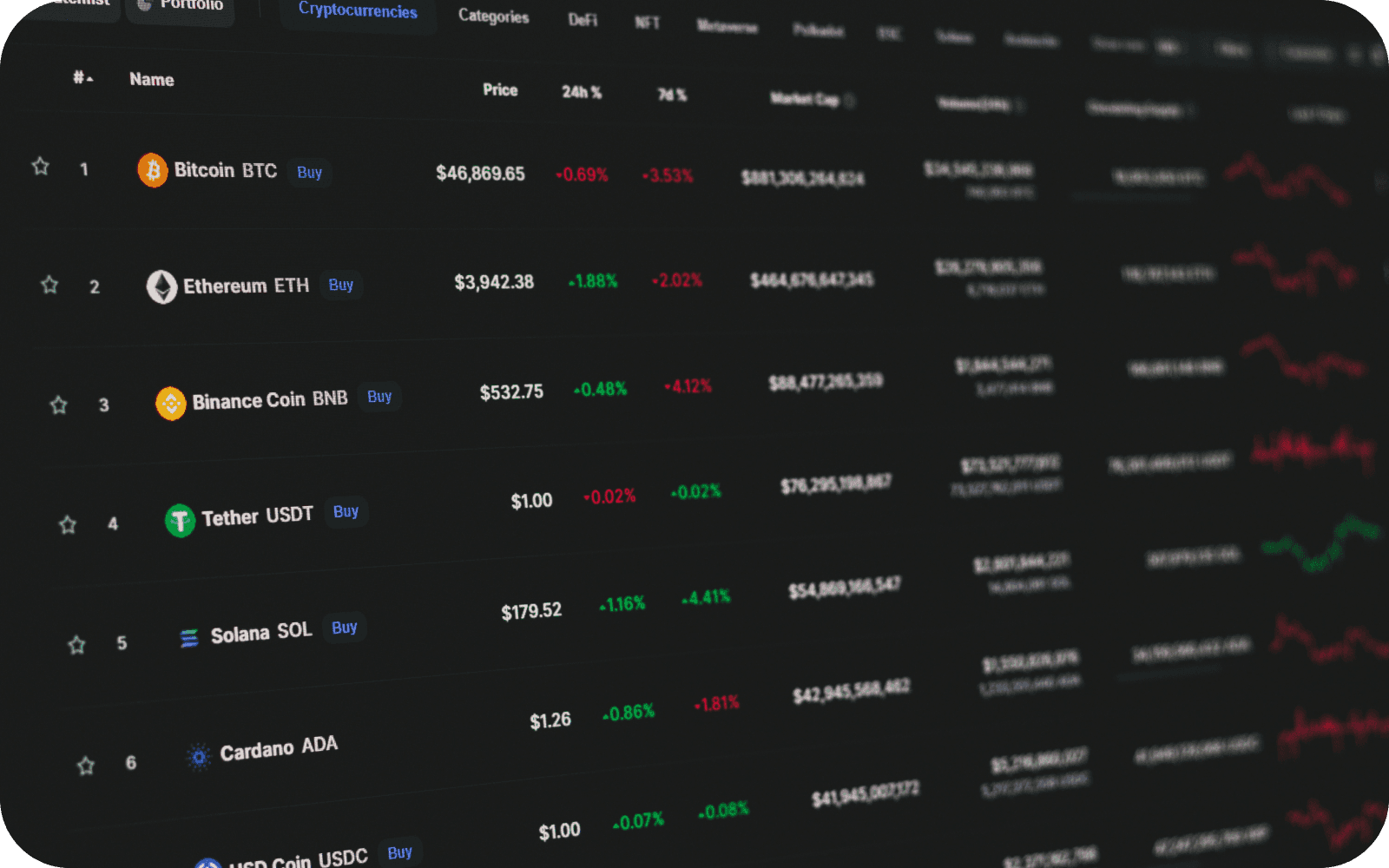

Currency Exchange

Currency exchange rates play a crucial role in shaping a country’s economic policies. These rates, which indicate the value of one currency relative to another, impact trade, inflation, and overall economic stability.

A country’s exchange rate directly affects its trade balance. A weaker currency makes exports more competitive globally, while a stronger currency increases the affordability of imports, influencing trade dynamics.

Exchange rates influence inflation levels. A depreciating currency raises the cost of imported goods and services, leading to higher consumer prices. Policymakers often adjust monetary policies to control this impact.

Central banks consider exchange rates when setting interest rates. A high exchange rate may prompt lower interest rates to stimulate domestic spending, while a low rate might lead to hikes to curb inflation.

Exchange rate fluctuations affect foreign investments. A stable and favorable exchange rate attracts investors, while excessive volatility can deter them, impacting the country’s economic growth.

Governments incorporate exchange rates into fiscal policy decisions. A strong currency can encourage imports but may harm domestic industries, prompting measures like subsidies or tax adjustments.

Exchange rates influence a country's global competitiveness. Policymakers often aim to maintain a balanced exchange rate to support both domestic industries and international trade relationships.

In some cases, countries may intervene in currency markets to influence exchange rates. While this can provide short-term advantages, it often draws criticism and impacts global economic relations.

Currency exchange rates significantly shape a nation’s economic policies. By carefully managing these rates, governments and central banks can foster economic stability, control inflation, and promote sustainable growth.